asia investment outlook

Developing Asia Outlook Reflecting worsened economic prospects growth forecasts for developing Asia are revised down relative to those in the ADO in April. The 2022 Global Investor Outlook report is based on the results of a focused investor survey and in-depth interviews with our Capital Markets leaders across the world exploring investor sentiment strategies and the forces that will shape global real estate markets in 2022.

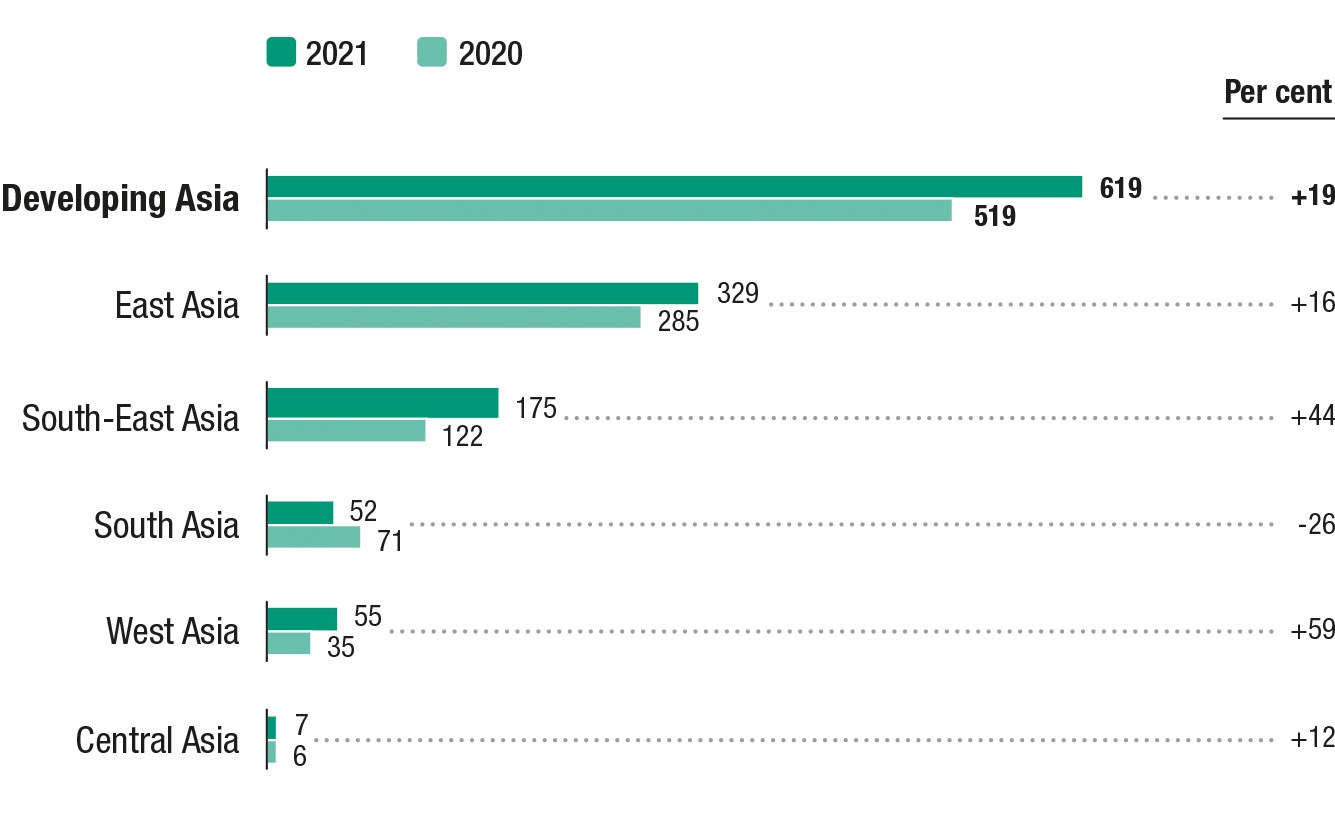

Foreign Investment In Developing Asia Hit A Record 619 Billion In 2021 Unctad

Financial data provider Preqin predicts that throughout 2025 the private debt asset class will be the second-fastest-growing alternative investment hitting 146 trillion in.

. We expect Brent prices to remain in the 45-55 range in the first half of 2021 and 50-60 in the second half. Abrdn Nikko AM Fullerton. Optimistic prospects for real estate investments across Asia Pacific.

Opportunities in a Climate of Change. Asia ex Japan equities had an eventful 2021. Valuations for the broader China market have pulled back a long way and a much weaker growth outlook is priced in so downside risks should be less than six months ago.

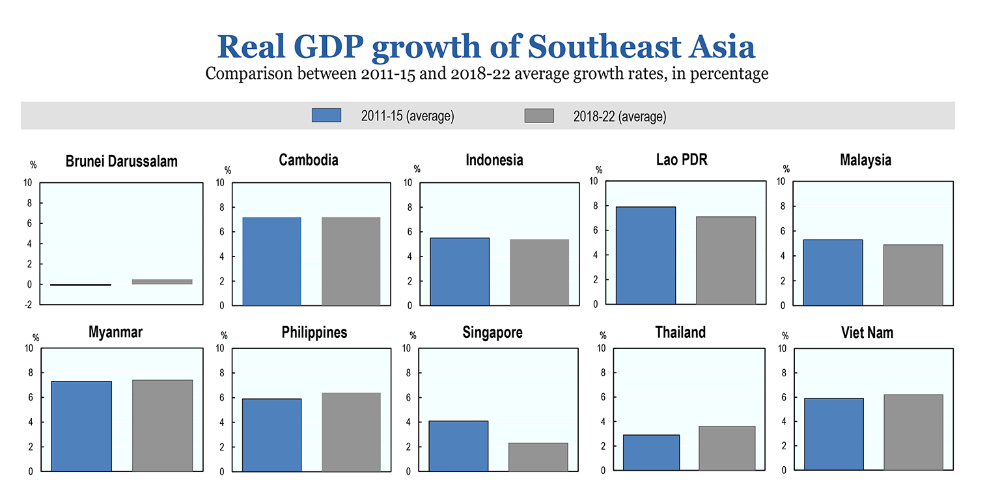

JLLs research unveils more key trends for the year. Slowing productivity growth is another key challenge for Asia as it is for other regions. We do not see a potential Evergrande default as a trigger for a systemic financial meltdown.

The range of industries and stocks we are interested in investing in has become narrower. The CSI 300 which features 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges is down around 45 trading at 18 times earnings and the MSCI AC Asia Pacific Index which represents large and mid-cap stocks in developing and advanced economies in Asia is down about 1 and trading at a multiple of around 16. Foreign Direct Investment Trends and Outlook in Asia and the Pacific 20212022 Report 15 December 2021 The COVID-19 pandemic has contributed to the collapse of global foreign direct investment FDI flows which fell 42 per cent from US15 trillion in 2019 to an estimated U859 billion in 2020.

That said markets have moved fast to price in the changing outlook. For more economic and asset class insights see our full 2022 Investment Outlook. An unwelcome blast from the past.

And 3 ESG taking into account that these topics do not neatly lend themselves to cookie-cutter solutions because no two insurers are exactly alike. Its investor-friendly policies extensive network of Foreign Trade Agreements FTAs economic and political stability and cost-effectiveness are among the reasons Vietnam sustained positive FDI inflows throughout a heavily COVID-affected 2021. Debt problems at property developer Evergrande were one of the major obstacles in 2021.

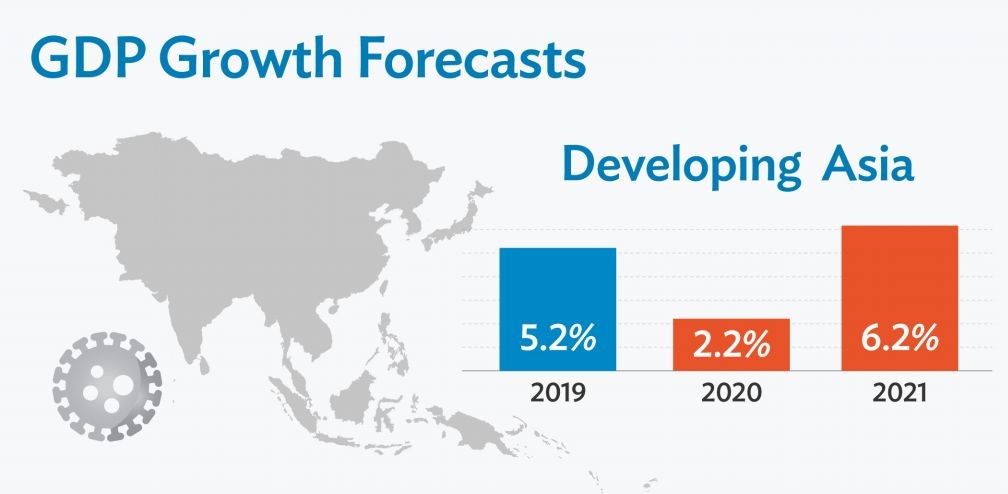

Global demand weakened by the pandemic will weigh on the 2020 outlook particularly in the more open subregions and tourism-dependent economies like those in the Pacific. Growth in developing Asia slowed to 52 in 2019 from 59 in 2018 handicapped by trade tensions a downturn in electronics and weak domestic investment. Buoyed by a strong economic outlook Asia Pacific real estate investments are expected to rise 15 in 2022.

Asian stocks look cheap compared to both current levels in the US and Europe and historical valuations. Asia Outlook for 2H20 and 2021. Vietnam is a strong candidate for foreign investors from across the world.

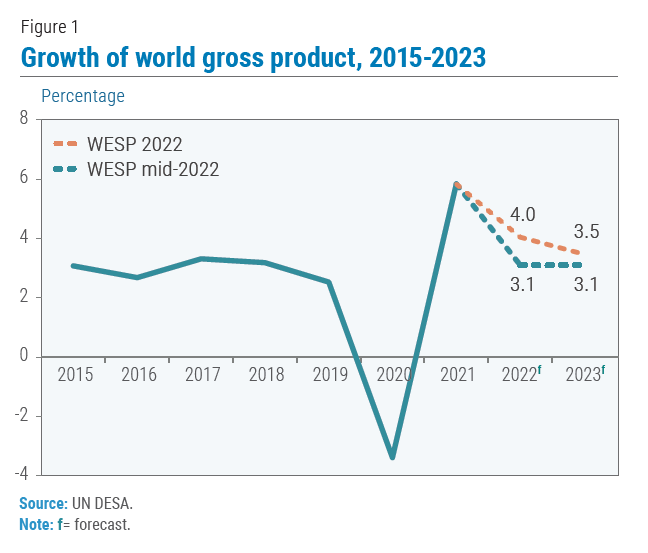

Investing in Asia 2022 The outlook for investing in Asian assets in light of rising inflation and volatility Asia 13 Jan 2022 2 min read Like Is the inflation debate relevant for Asian bond investors. We expect to see above-trend global growth at 48 in 2022 slower than this years 56 forecast but nevertheless a strong year. The April 2017 Regional Economic Outlook.

The Asia-Pacific regions prominence in global merchandise trade value has slightly declined in 2021 to 410 of the worlds exports and 368 of global imports compared to the regions 415 and 371 share of global exports and imports respectively in 2020. Our 2022 outlook for global insurers is framed around the three key themes of. Asia and Pacific documented the slowdown in Asia since the global financial crisis and identified its main drivers including declining research and development RD investment trade openness and FDI.

Risks to the regions economic outlook remain elevated and mainly associated with external factors. The CSI 300 which features 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges is down around 45 trading at 18 times earnings and the MSCI AC Asia Pacific Index which represents large and mid-cap stocks in developing and advanced economies in Asia is down about 1 and trading at a multiple of around 16. Theme 1 Inflation.

Optimism for the new year is soaring as regional markets chart their paths towards a post-pandemic future. Our speakers discuss why inflation will not be a transitory risk and how the debate is shaping allocation decisions. COVID-19 is having a severe short-term impact on Asia but the long-term impact should be small.

To help investors better understand and navigate todays investment environment Mr Tai Hui chief market strategist for Asia-Pacific shares our perspectives on the top questions on the minds of. Three investment strategists give their opinion on what lies ahead for Asian Equities in 2022. Chinese shares in particular faced a number of headwinds and the ripple effects from these are likely to spill into 2022.

The reopening of borders will likely spur recovery in cross-border. Strategic Tactical Allocation. The issuer of this document is PineBridge Investments Asia Limited a company incorporated in Bermuda with limited liability licensed and regulated by the Securities and Futures Commission SFC.

Recent sharp fall in oil prices also improves the inflation outlook. In 2021 the IMF expects 82 y-o-y GDP growth for China 60 for India and 24 for Japan. Excess capacities will cap prices in 2021 but the outlook for 202223 is bullish due to the lack of investments in the recent years.

Hence policy normalisation will be the norm for next year. February 18 2022. From 52 to 46 for 2022 and from 53 to 52 for 2023.

The Fed is likely to accelerate tapering with the program ending in March 2022.

Developing Asia Economies Set To Grow 5 2 This Year Amid Global Uncertainty Asian Development Bank

World Economic Situation And Prospects June 2022 Briefing No 161 Department Of Economic And Social Affairs

The Oecd And Southeast Asia Oecd Southeast Asia

Strong Foundations Asian Infrastructure Is Open For Business White Case Llp

Indonesia S Economic Growth To Strengthen In 2022 2023 Adb Asian Development Bank

Growth In Emerging Asia To Rebound In 2021 Asian Development Bank

Will Inflation Stay Under Control In Asia Economist Intelligence Unit

Economic Outlook Asia Pacific Q3 2022 Overcoming Obstacles S P Global Ratings

Regional Policy Networks Oecd Southeast Asia

Assessing China S 2022 Economic Outlook Based On 2021 Data Points

Strong Foundations Asian Infrastructure Is Open For Business White Case Llp

Economic Outlook Asia Pacific Q3 2022 Overcoming Obstacles S P Global Ratings

Economic Outlook Asia Pacific Q3 2022 Overcoming Obstacles S P Global Ratings

Insight/2022/06.2022/06.14.2022_APAC_Economic_Charts/real-gdp-projections-asia-pacific.png?width=1434&name=real-gdp-projections-asia-pacific.png)

Insight/2022/06.2022/06.14.2022_APAC_Economic_Charts/china-quarterly-gdp-growth-outlook.png?width=1671&name=china-quarterly-gdp-growth-outlook.png)

Comments

Post a Comment